rhode island tax table 2021

Rhode Island Single Tax Brackets TY 2021 - 2022. Detailed Rhode Island state income tax rates and brackets are available on.

Connecticut Tax Forms And Instructions For 2021 Ct 1040

Rhode Island Estate Tax.

. RI-1040 can be eFiled or a paper. The Rhode Island Single filing status tax brackets are shown in the table below. Tax Rate Starting Price Price Increment Rhode.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. Please use the link below to download 2021-rhode-island-tax-tablespdf and you can print it directly from your computer. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Single is the filing type used by all. The state income tax table can be found inside the Rhode Island. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Any income over 150550 would be. If the employers average Rhode Island withholding for the previous calendar year is 200 or more per month the employer is required to file and remit the monthly withholding tax by electronic. What is the Single Income Tax Filing Type.

These income tax brackets and rates apply to Rhode Island taxable income earned January 1. BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407 1407 1735. The chart below breaks down the Rhode Island tax brackets using this model.

More about the Rhode Island Tax Tables We last updated Rhode. Over But not over Pay percent on excess of the amount over 0 2650 375 0 2650 8450 9938 475. Taxation in the Tax Credit and Incentive Report Fiscal Year 2021 did not comply with the Rhode Island General Laws as it pertains to the submission to the Tax Administrator of each full-time.

Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. Income tax rate schedule for tax year 2021 trusts and estates Taxable income. Everything You Need to Know - SmartAsset The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and.

Find your income exemptions 2. Tax Bracket Tax Rate. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table 1.

The Rhode Island Department of Revenue is responsible for publishing the latest Rhode Island State Tax Tables each year as part of its duty to efficiently and effectively administer the. However if Annual wages are more than 231500 Exemption is 0. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect your applicable local sales tax rate.

Find your pretax deductions including 401K flexible account. Withholding Formula Rhode Island Effective 2022. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. MUNICIPALITY NOTES RRE COMM PP MV. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay.

Apply the taxable income computed. Subtract the nontaxable biweekly. If you want to qualify for this tax rebate taxpayers needed to have at least one dependent that was not older than 18 years as of December 2021.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. More about the Rhode Island Form 1040 Individual Income Tax Tax Return TY 2021 Form RI-1040 is the general income tax return for Rhode Island residents. FY 2021 Rhode Island Tax Rates by Class of Property.

Luckily people from Rhode.

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

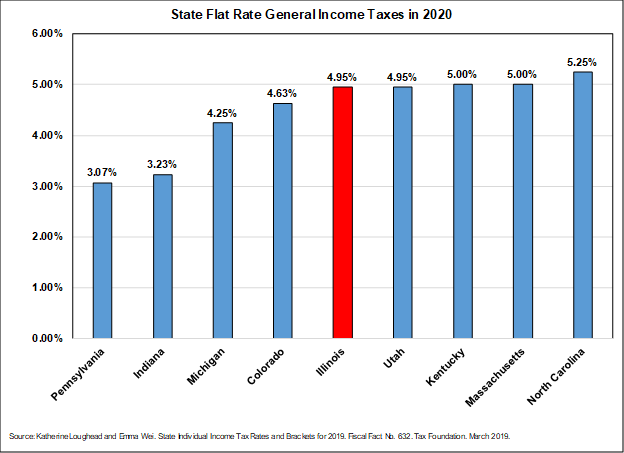

Monday Map Top State Income Tax Rates Tax Foundation

Rhode Island Tax Credits Ri Department Of Labor Training

Individual Income Tax Structures In Selected States The Civic Federation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Brackets 2020

Historical Rhode Island Tax Policy Information Ballotpedia

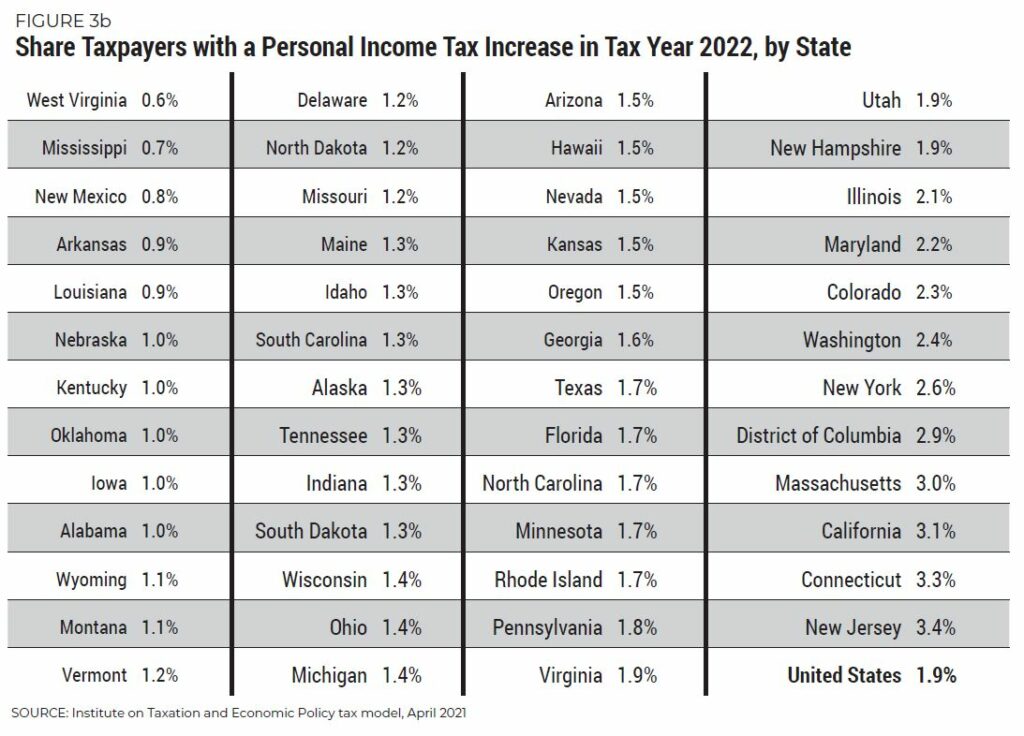

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation